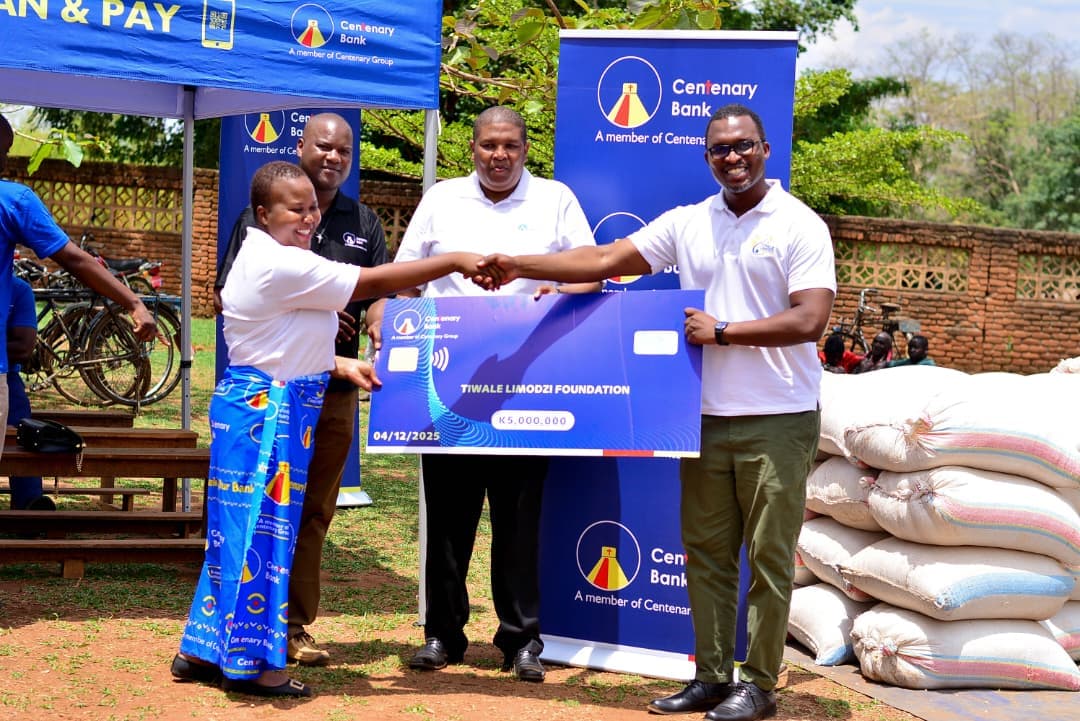

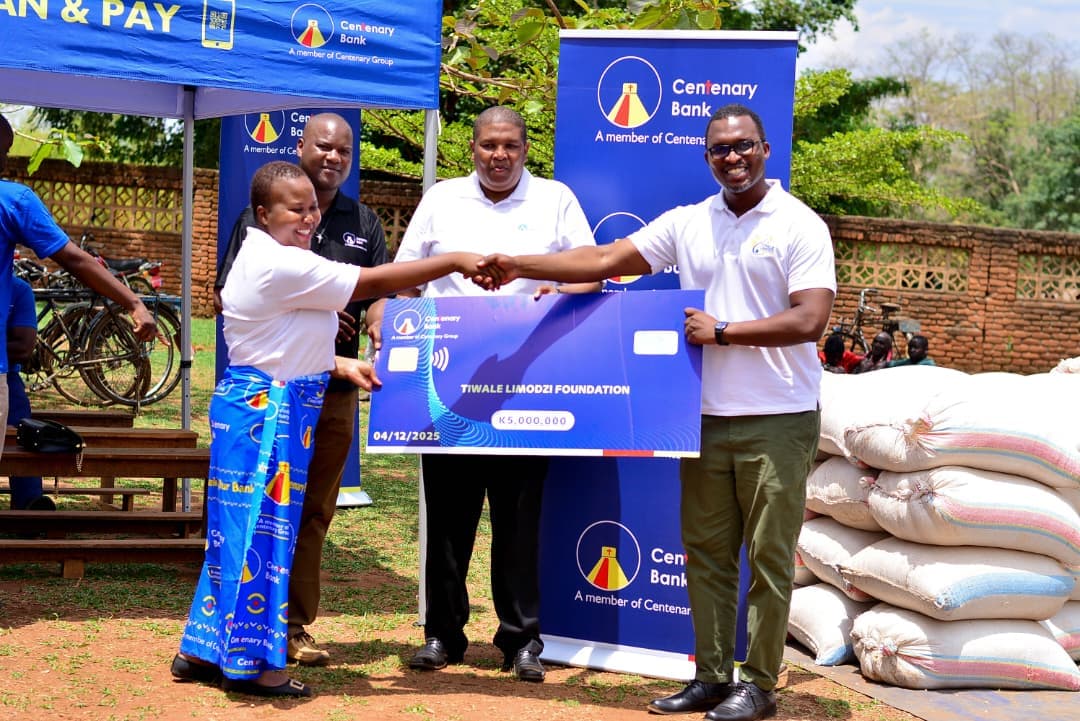

Centenary Bank Donates K5 Million to Support Hunger-Affected Families

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

One of Centenary Bank Limited SME Banking Customer; Mr Paliani Kamoto who trades under the name “Kamoto Investments”, has commended the bank for being a true partner that understands his business needs and willing to journey with him towards the attainment of his business goals and vision.

One of Centenary Bank Limited SME Banking Customer; Mr Paliani Kamoto who trades under the name “Kamoto Investments”, has commended the bank for being a true partner that understands his business needs and willing to journey with him towards the attainment of his business goals and vision.

The business story of Mr Kamoto started 20 years ago upon finishing his studies, when he decided and opted to be an entrepreneur and an employer-unlike being an employee like many of his peers at that time.

“It was around the year 2000, towards the dawn of the new millennium when I ventured into business. After a number of failed business venture attempts, I started off a minibus business and over a number of years my fleet grew to 8 minibuses. However, due to stiff competition and other pressing personal needs, at around 2016 I decided to diversify into selling of motor vehicle spare parts after conducting a thorough research in this new business area. As a person who is based in Ndirande, and taking into consideration the social capital that I have built over the years with garage owners within Ndirande, I saw a gap that I felt I would easily fill. To raise capital for the new venture and also carter for other personal pressing needs, I sold off 5 minibuses and out of the proceeds, I took Mk3 million and invested it as a start-up Capital for the spare parts business which is now called “Kamoto Auto-parts”. Kamoto Said

At the onset of his auto-parts business, he used to go to buy the spare parts in Da res salaam and would frequent the port city of Tanzania to replenish his supplies as and when needed to meet his customers’ needs and demand. He would reinvest the profits made to increase his stock holding over time and sell the parts at his first container shop – which is still operational; located opposite Total filling station in Ndirande Chinseu.

“When I started Kamoto Auto-parts, the business was doing considerably well and to meet my growth aspirations I started looking for a bank that I can partner with. Through my research and referrals from friends; I settled for Centenary Bank Limited, a decision that I will never regret to date. At that time at around 2017-2018 I wanted a boost in my working capital to enable me open more outlets and also increase my stockholding and this aspiration partly came into fruition when Centenary Bank Limited offered me a very good loan. When I took the loan I was able to buy my stock from Dubai at a relatively lower price compared to Da res salaam thereby increasing my profit margin and was able to grow my business further. This in turn made it possible for me to pay off the loan in good time and took another big loan that has also helped to boost my business further. As we speak now, I now have 2 shops in Ndirande and one shop in down town Blantyre along Haile Selassie road. My fleet of Minibuses and trucks is also growing as we speak, growth being fuelled by the auto-parts business. Most importantly through my business I have employed almost 10 people hence contributing to the lowering of un- employment levels in the country” Kamoto said.

In addition to financing from the bank, Kamoto also explained that since his business is partly an import business, the bank also provides him with solutions that help to manage risk and make cross border transactions flexible, simple and cost effective.

“Every time I am in need of Forex or want to buy things online or via LC’s, Centenary Bank Limited always delivers in my case. In addition their Flex Online internet banking enables me to manage my accounts 24/7 hence simplifies the way I do business for a person who is very busy like me, this affords me the much needed convenience. In totality, my partnership with Centenary Bank has simplified my life as a business man and has made a very positive impact to my life.

Being an entrepreneur for close to two decades, Kamoto also hinted his fellow business persons to uphold the highest level of financial prudence, in order to build sustainable businesses.

“Over the years I have been doing business I have interacted with many business persons and it is unfortunate that I have witnessed many businesses come and go-others even bigger business than mine. I have seen businesses operating at a level where banks trust them and are able to get big loans but instead of investing the loan into the business, they diverted funds for unsustainable life style needs thereby chocking the business to fail to pay back loans and banks resorting to repossess their assets. I have seen businesses doing very well but failing to grow because they don’t keep their books in order making it difficult for them to access loans when needed. Throughout all these experience, my advice to all entrepreneurs who want to build sustainable business that will stand the test of time is –Financial Discipline.

Save you money in a bank, keep accounts of your business, if you are given the opportunity to borrow from Banks, don’t borrow for consumption always borrow when you see a need to invest the money in your business as this will help you repay easily. I have followed this philosophy all this time and from some of the profits I have made over time, I am able to send my four Kids to decent schools, I, my wife and kids are able to drive nice cars and live in a beautiful home that we have managed to build without breaking the bank”. Kamoto said

On her part,Centenary Bank Limited Managing Director, Zandile Shaba said she is humbled and glad that the bank is making a positive social impact to its customers and Malawi at large.

“It is pleasing to realise that as a bank we are making positive strides towards attaining one of our strategic intent encapsulated in our vision of becoming the best bank in Malawi in terms of social impact. The story of Kamoto investments is a true testament that we are indeed on the right track towards attaining our aspiration and vision. For us making a positive social impact goes beyond the CSI and Sponsorships initiatives that we embark on; as it also ensures that the products and services that we offer contribute to uplifting our customers’ personal lives and businesses as is the case with Kamoto Investments. At Centenary Bank Limited, partnership is at the core of everything we do. By immersing ourselves in the industries our clients operate in we are truly an extension of their team. Using our insights and expertise, we help them achieve their aspirations hence becoming the partner they can truly rely on; the right partner who understands and fulfil their needs” Shaba said.

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions 1. Declaration and Authorization by Applicant I, the ...

At Centenary Bank, we believe banking should do more than just hold your money, it should empower you, protect you, and ...