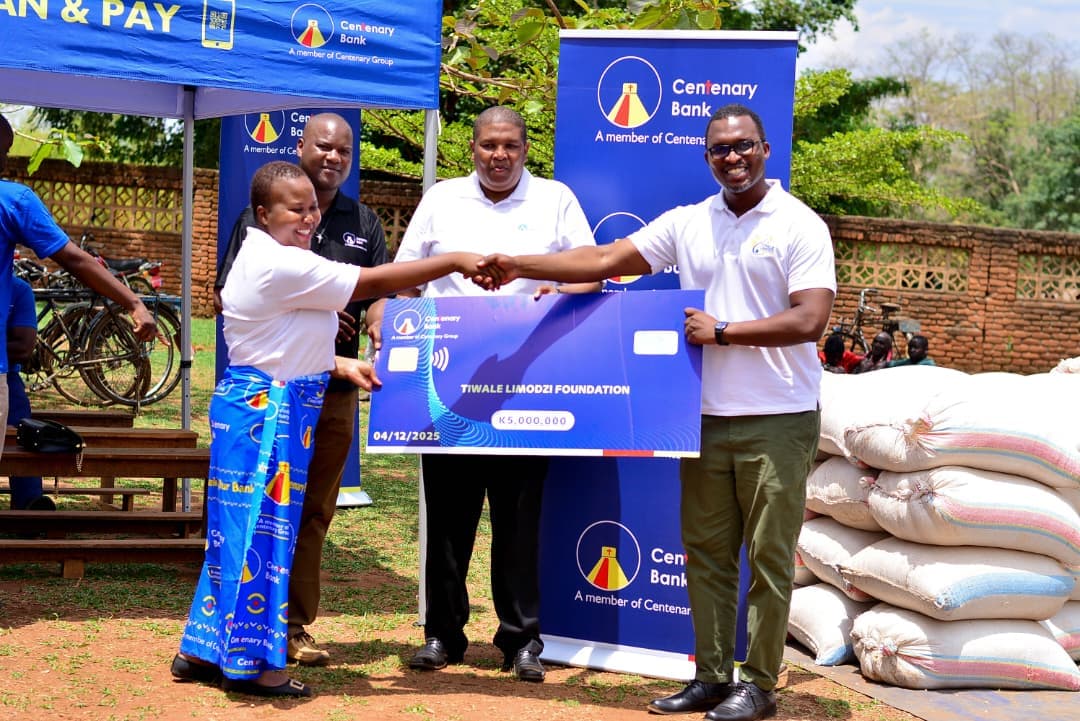

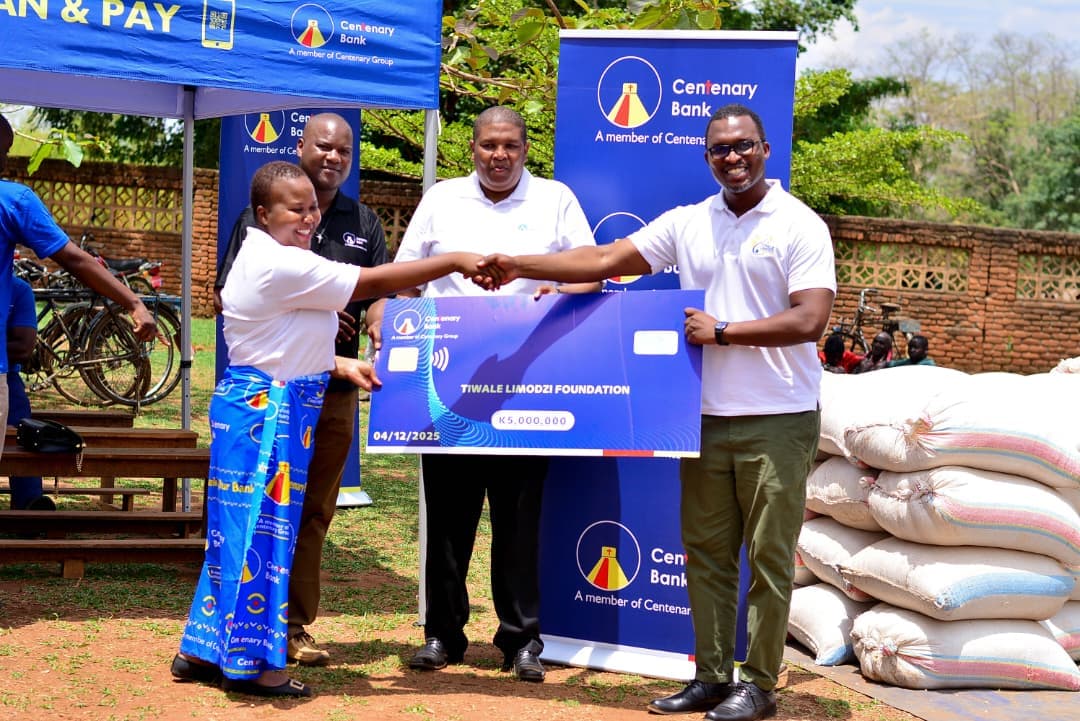

Centenary Bank Donates K5 Million to Support Hunger-Affected Families

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

Centenary Bank has reported a K594 million profit-after-tax for the year ended December 31, 2023, from a K3.9 billion loss recorded in 2022. This is according to a summary of audited results the bank published last week, downloadable on the here.

In the report, the bank rates 2023 as a recovery year following adverse performance in the previous two years.

"The group achieved significant progress, specifically in business growth, customer confidence, improvement in liquidity, and enhanced customer experience. We have attained business volume growth and reduced the cost of doing business despite increasing economic pressures,"

However, it laments the continued downside risk the bank is facing in terms of increased impairments from existing facilities arising from economic conditions that have negatively affected its performance.

The bank reported earning K18.1 billion in interest income compared to the prior year's interest income of K15.0 billion, representing a 20 percent growth. Interest expense for the year was seen at K7.6 billion against the prior year's expense of K7.8 billion, representing a 2 percent interest expense reduction.

Total non-interest revenue increased by 92 percent to K10.0 billion from K5.2 billion earned in 2022 due to an increase in exchange gains and an increase in commissions earned on lending and transaction fees. Impairment charges on loans and advances to customers declined by 31 percent to K1.8 billion in 2023, which is still on the higher side from K2.6 billion in 2022. Operating expenditure rose by 17 percent to K17.8 billion from K15.2 billion reported in 2022, mainly due to inflationary pressures. Total assets for the firm increased by 59 percent to close at K123 billion in 2023 from K77.2 billion in 2022, according to the report.

"The growth is mainly driven by increased customer deposits arising from business growth strategies and changes in shareholding. The group's earnings per share for the year increased to K39.00 in 2023 from (K683) in 2022. Meanwhile, on outlook, the bank says it expects macroeconomic pressures to persist in the first half of 2024 and ease in the second half. It has since expressed optimism about continuing with business growth as it continues to implement the various business growth strategies embarked on since the start of 2023.

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions 1. Declaration and Authorization by Applicant I, the ...

At Centenary Bank, we believe banking should do more than just hold your money, it should empower you, protect you, and ...