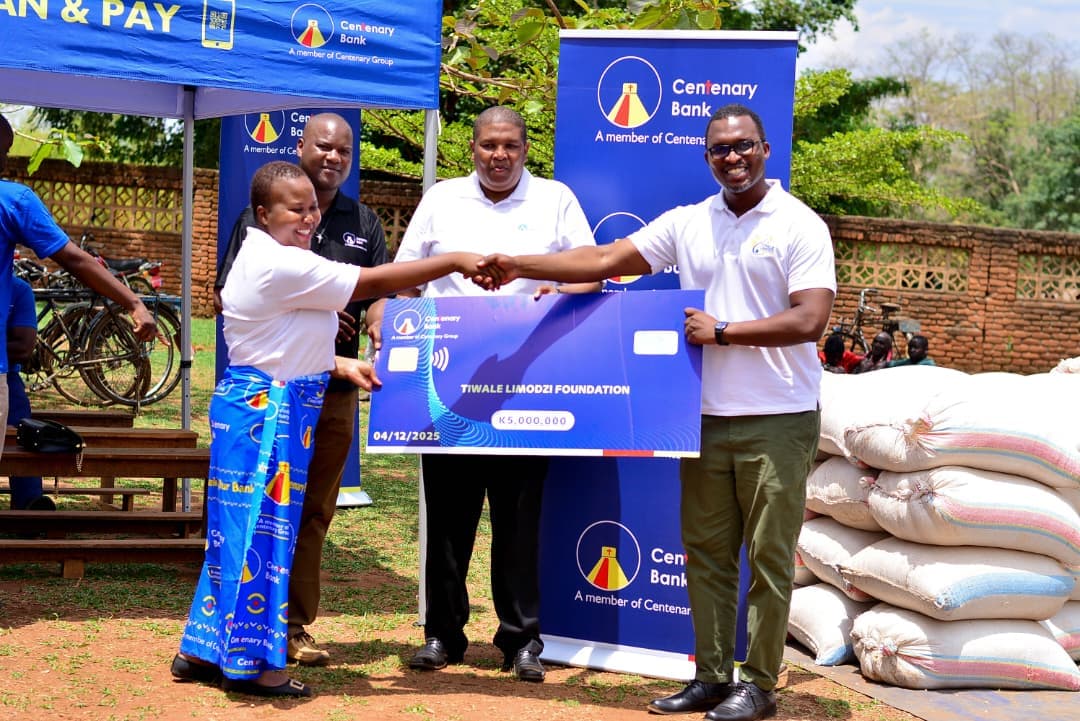

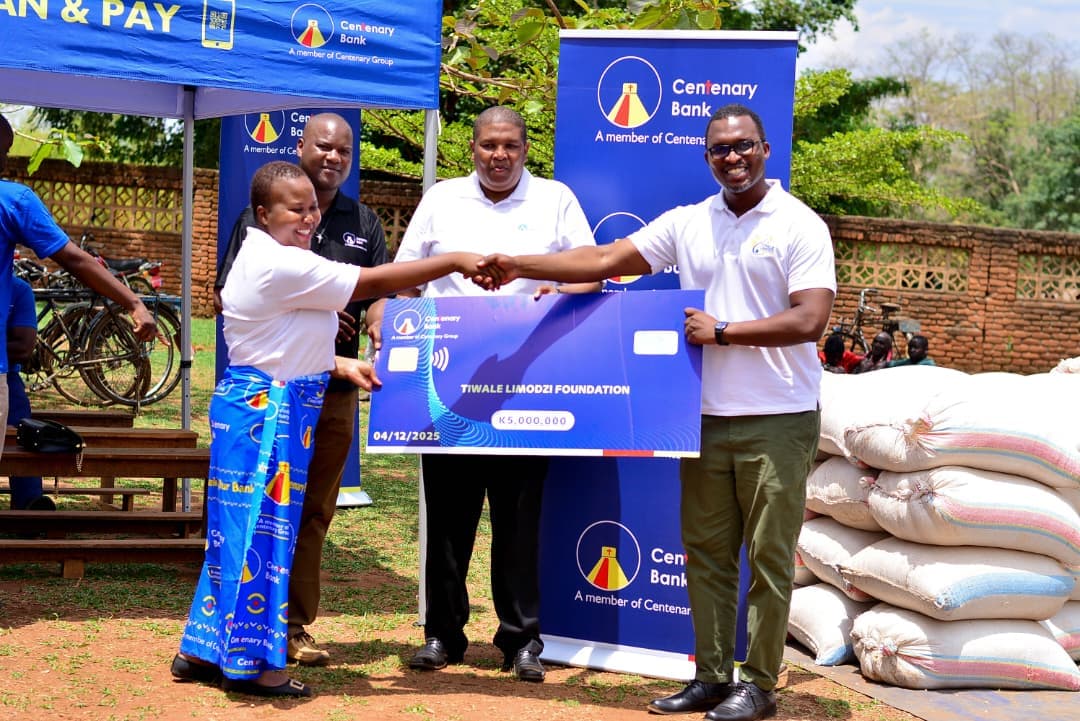

Centenary Bank Donates K5 Million to Support Hunger-Affected Families

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

Centenary Bank Limited has recorded an impressive profit-after-tax of K970.4 million for the first half of 2023, marking a significant step towards recovery from two years of losses. This encouraging performance highlights the positive impact of the recent capital injection and change in shareholding at the beginning of this year.

Centenary Bank Limited has recorded an impressive profit-after-tax of K970.4 million for the first half of 2023, marking a significant step towards recovery from two years of losses. This encouraging performance highlights the positive impact of the recent capital injection and change in shareholding at the beginning of this year.

The bank's overall profit surged to K970.4 million during the review period, compared to a loss-after-tax of K959 million in the same period last year.

This achievement can be attributed to our concerted efforts to improve key performance areas and steer the bank in the right direction.

The net interest income has grown by 59 percent, reaching K5.3 billion compared to the same period in the previous year's K3.3 billion, largely due to a reduction in the cost of funding. Additionally, noninterest revenue increased by 59 percent, and the total income experienced growth of 64 percent.

While we celebrate our success, we also recognize the challenges ahead. Impairment charges on loans and advances to customers rose by 111 percent, and operating costs increased by 14 percent. However, our assets also grew by 12 percent, reflecting our commitment to maintaining a strong financial position.

The bank remains resolute in its commitment to improving customer satisfaction and operational efficiencies. Our ongoing efforts include upgrading systems and driving the digitalization agenda to enhance customer experience and grow our business further.

This year marks a significant milestone as it is the first year since the shareholding of the Bank changed from MyBucks S.A. to Centenary Rural Development Group Limited and Lilongwe Archdiocese of the Catholic Church, with respective holdings of 51 percent and 49 percent.

Centenary Bank Limited is dedicated to maintaining strong financial performance, promoting sustainable growth, and providing reliable banking services to our valued customers and communities.

Click here to access the Half year published financial results.

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions 1. Declaration and Authorization by Applicant I, the ...

At Centenary Bank, we believe banking should do more than just hold your money, it should empower you, protect you, and ...