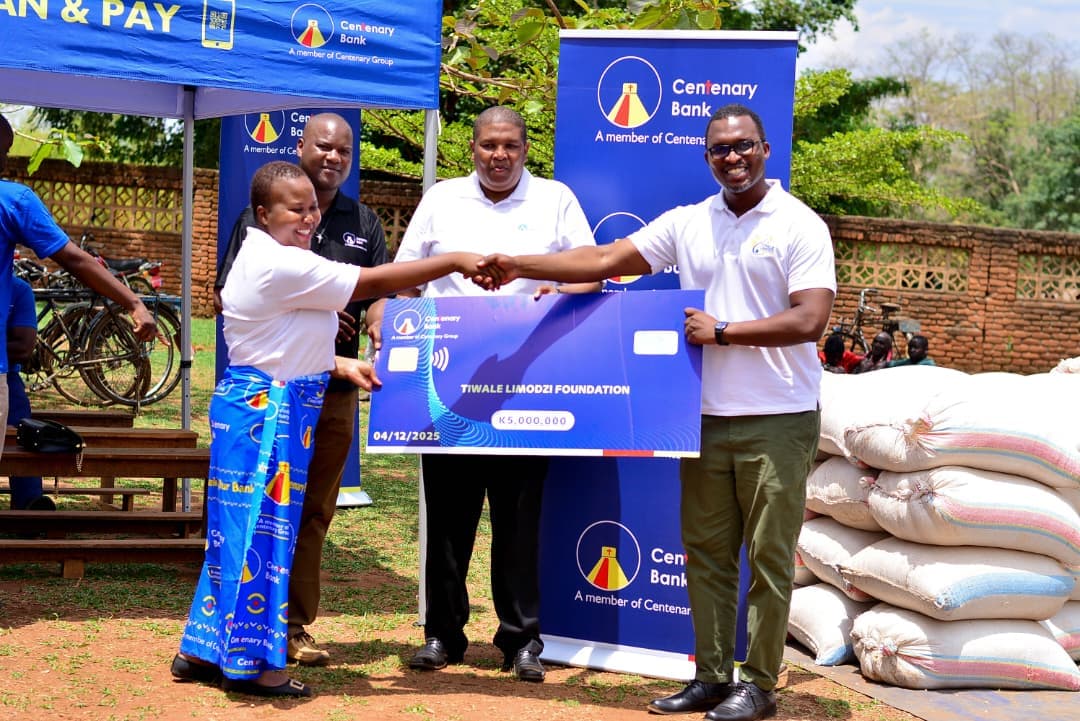

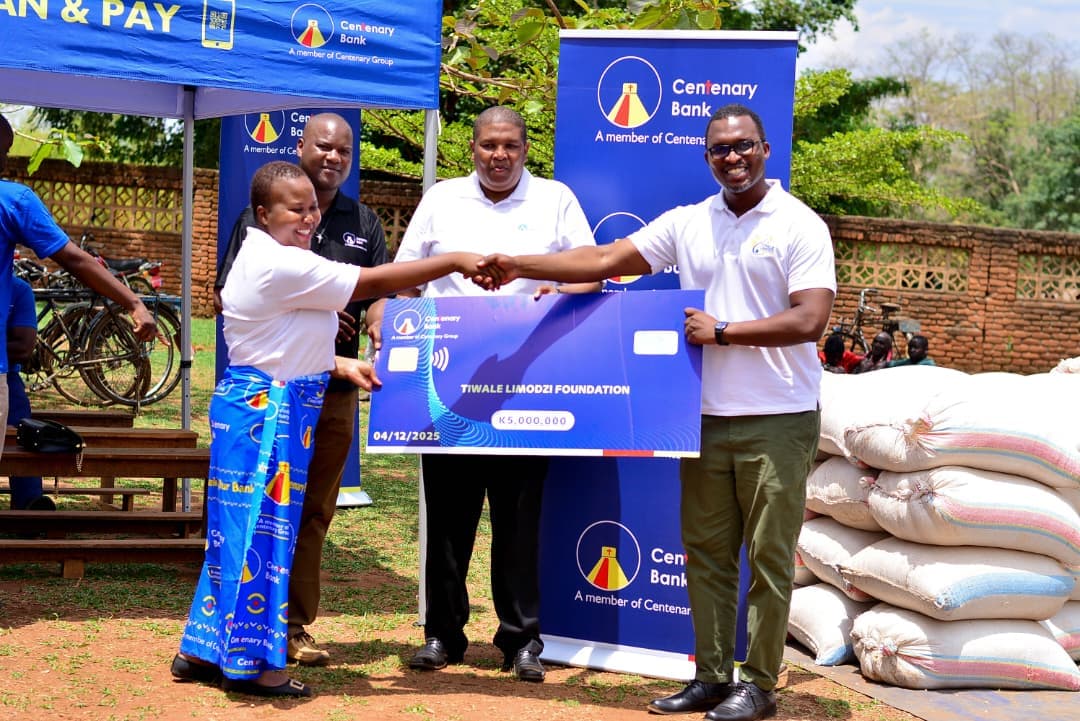

Centenary Bank Donates K5 Million to Support Hunger-Affected Families

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions

I, the applicant, declare and agree that:

By signing this agreement, I give Centenary Bank Limited permission to: a. Contact anyone to check that the information I have given in Part A is correct. b. Obtain details from any party about my financial status and banking details, including a credit record and payment history. c. Give information about this loan to any party, including the credit bureau. d. Assign its right, title, and interest herein to any party or entity nominated by Centenary Bank Malawi. e. Report details to the Malawi Police or similar organization where fraud is committed. f. Forward marketing material and offerings of other products of Centenary Bank Malawi to me.

You apply for a loan by completing and signing this document. Only when Centenary Bank Malawi approves the loan and pays it out to you will this document become a binding agreement between Centenary Bank Malawi and you.

After Centenary Bank Malawi has approved the loan application, the loan will be paid into the bank account indicated in Part A. You agree that you cannot hold Centenary Bank Malawi responsible for any damage or loss caused by transferring the loan into the indicated account. If payment is not received within 72 hours, please refer to the nearest Centenary Bank Branch or Corporate Office, and upon providing proof, you may elect to cancel this agreement.

Interest charged on the loan will be at the fixed rate, calculated and capitalized over the reduced balance. Should you fail to make a payment on the due date, or where Centenary Bank Malawi grants you an extension for payment, interest on the full outstanding amount will be capitalized monthly at the Bank’s discretion and charged at the fixed percentage referred to in Part A. If legal action is required for recovery, Centenary Bank Malawi shall be entitled to claim interest at the agreed fixed percentage.

Once the loan amount has been paid to you, this contract is in effect and you are obliged to repay the full contractual amount to Centenary Bank Malawi. However, Centenary Bank Malawi allows a 10 working day “cool-off” period.

Credit life cover provides for settlement of the loan in the event of untimely occurrences such as death or permanent disability. There is no insurance cover for disability, retrenchment, dismissal, or loss of employment if the borrower’s arrears or charges predate the insured event.

This agreement is the only agreement between you and Centenary Bank Malawi. Any changes must be made in writing.

All fees (Origination fees, Credit Reference Bureau costs, Insurance, and embedded funeral cover) will be charged upfront. Collection costs will be charged as per the ruling rate schedules.

After disbursement, you will owe Centenary Bank Malawi the full contractual amount as set out in Part A. This must be repaid in equal instalments as shown. Repayments will first pay legal costs (if any), then penalty interest (if any), followed by total cost of credit, and lastly the outstanding balance.

The administration/origination fee is non-refundable and will not be discounted on a pro-rata basis upon early settlement. You may settle this agreement at any time by paying the unpaid balance, interest, and any other charges due up to the date of settlement, having obtained a settlement quotation from the Bank.

Centenary Bank Limited may immediately demand payment of the full outstanding amount if you:

Exercising this right does not limit other legal rights available to Centenary Bank Limited

Failure by Centenary Bank Limited to act on default does not waive its right to take future legal action or exercise any other right.

This agreement is subject to the laws and jurisdiction of Malawi.

Centenary Bank Malawi may provide non-public personal information to non-affiliated third parties performing services or marketing on behalf of the Bank, in compliance with the Microfinance Act of Malawi [Paragraph 17(2)]. All such third parties must maintain confidentiality under contractual agreement. Except as required by law, Centenary Bank Malawi shall not disclose your non-public personal information without your written consent.

All notices from Centenary Bank Malawi will be sent to your address as reflected in Part A. Notices sent by registered post will be deemed received within 10 days. Any change of address must be communicated in writing.

PART D — Direct Standing Order Authorisation (Secondary Collection Method)

PART E — Credit Life Insurance Policy Terms and Conditions

This policy is underwritten by Smile Life Insurance Company Limited and provides benefits in the event of the Life Assured’s death or permanent disability. All claims under this policy will be paid directly to Centenary Bank Malawi to settle any outstanding loan balance.

-Cover coincides with the loan tenure (maximum 60 months or until age 70, whichever comes first). -Cover begins on the loan disbursement date. Entry age: 18–60 years.

a. Death Benefit (Life Cover) Upon the Life Assured’s death, Smile Life shall pay the outstanding loan balance to Centenary Bank. An additional MK150,000 will be paid to the named beneficiary upon submission of required documents.

b. Permanent Disability Cover Payable if the Life Assured becomes permanently unable to work due to injury or illness:

-A six-month deferred period applies. -Three-month waiting period for natural causes (none for accidents). -Must be certified by a qualified medical practitioner. -Employer confirmation of absence due to disability is required.

No payment will be made for: a. Disability occurring before policy commencement. b. Disability arising while the member has been unemployed for more than six months.

No benefits will be paid for: a. Intentional self-inflicted injury, suicide, or attempt within the first 12 months. b. Airborne pursuits other than as a passenger in a certified aircraft. c. Participation in war, riot, strike, civil commotion, or military/police action.

Cover terminates on the earlier of: a. Loan repayment in full. b. Cessation of premium payments. c. Payout of a qualifying benefit. d. Default for reasons not covered by the policy.

In the event of death:

In the event of disability:

Claims must be submitted in writing to: The Principal Officer, Centenary Bank Malawi, P.O. Box 31567, Ekistics House, City Centre, Lilongwe.

All claims must be submitted within 90 days of receipt of the claim form.

I hereby apply for Credit Life Insurance cover in relation to my loan from Centenary Bank Limited I confirm that I have read and understood all documentation, terms, and cost details contained herein.

Customer Signature: ______________________ Date: ______________________

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions 1. Declaration and Authorization by Applicant I, the ...

At Centenary Bank, we believe banking should do more than just hold your money, it should empower you, protect you, and ...